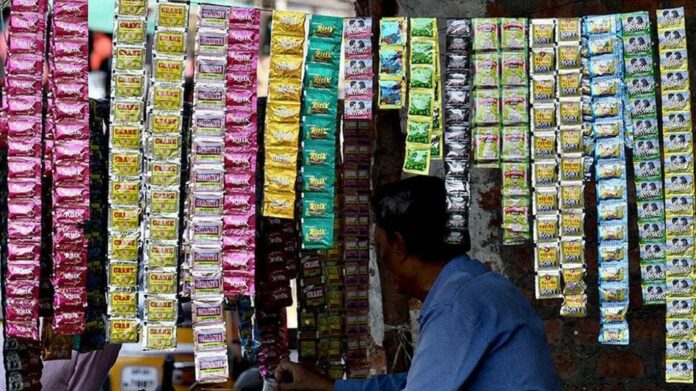

India will implement a revised taxation structure for tobacco products and pan masala from February 1, 2026, with the Union government officially notifying a new excise duty and cess framework that will replace the existing GST compensation cess, according to a report by PTI. The change represents a major shift in how so-called sin goods are taxed in the country.

Under the newly notified regime, pan masala, cigarettes and other tobacco products will continue to attract Goods and Services Tax, but at a higher slab of 40 per cent, while biris will remain taxed at 18 per cent. These GST rates will apply alongside additional levies, significantly increasing the overall tax burden on such products.

The Finance Ministry has announced that a Health and National Security Cess will be imposed on pan masala, while tobacco and tobacco-related items will be subject to an additional excise duty. These new charges will come into force simultaneously with the withdrawal of the GST compensation cess, which currently applies at different rates to tobacco and pan masala products.

In a parallel move aimed at tighter regulation, the government has also notified the Chewing Tobacco, Jarda Scented Tobacco and Gutkha Packing Machines (Capacity Determination and Collection of Duty) Rules, 2026. The rules establish a framework to assess manufacturing capacity and calculate duty liabilities, signalling closer monitoring of production in the chewing tobacco and gutkha segments.

The notification follows Parliament’s approval in December of two key Bills that empower the Centre to levy the Health and National Security Cess on pan masala and impose additional excise duty on tobacco products. With legislative clearance secured, the government was required to formally announce the rollout date, now fixed for February 1, 2026.

The GST compensation cess, originally introduced to offset states’ revenue losses after the rollout of GST, will be discontinued from the same date. By replacing it with a combination of cess and excise duty, the Centre has reshaped the tax structure while keeping levies high on products it deems harmful to public health. The revised regime is expected to affect manufacturers, influence retail prices and potentially alter consumption trends once it takes effect early next year.