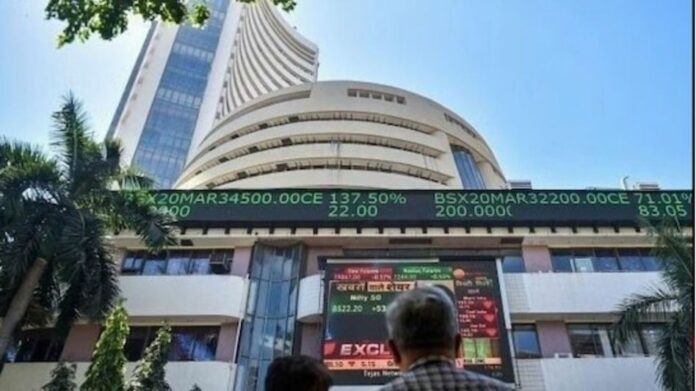

Business, Feb 3: Indian equity markets opened to a powerful rally on February 3, with benchmark indices posting one of their strongest single-session surges in recent times, buoyed by optimism following a landmark trade understanding between India and the United States. The agreement, which includes a sharp reduction in reciprocal tariffs on Indian exports, lifted investor confidence and triggered broad-based buying across sectors.

In early trade, the BSE Sensex vaulted 3,656.74 points to reach 85,323.20, while the NSE Nifty leapt 1,219.65 points to 26,308.05. The momentum strengthened as the session progressed, with the Sensex climbing as much as 4,205.27 points, or 5.14 per cent, to touch 85,871.73. The Nifty mirrored the surge, rising 1,252.80 points, or 4.99 per cent, to 26,341.20.

The sharp upswing followed confirmation from US President Donald Trump that New Delhi and Washington had finalised a trade deal during a recent conversation with Prime Minister Narendra Modi. Under the agreement, the United States will lower reciprocal tariffs on Indian goods to 18 per cent from the earlier 25 per cent, a move widely seen as a major boost for India’s export-driven sectors and overall economic growth prospects.

Heavyweights on Dalal Street led the charge, with stocks such as Adani Ports, Bajaj Finance, Eternal, Bajaj Finserv, InterGlobe Aviation and Reliance Industries registering gains ranging from nearly four per cent to over seven per cent. ITC was the only stock in the Sensex basket trading in the red amid the broader rally.

Market analysts described the development as a decisive positive for Indian equities. VK Vijayakumar, Chief Investment Strategist at Geojit Investments Limited, said the long-anticipated India–US trade agreement and the substantial tariff cut could prove transformational for both the economy and financial markets. He noted that, alongside the EU–India trade deal and a growth-oriented Union Budget, the agreement has significantly improved the investment outlook, with markets already factoring in these tailwinds.

Supportive global cues further reinforced sentiment. Major Asian markets were trading higher, with South Korea’s Kospi rebounding sharply by around five per cent, while Japan’s Nikkei 225, China’s Shanghai Composite and Hong Kong’s Hang Seng also posted gains. Wall Street had closed on a positive note overnight.

Institutional activity showed a mixed trend, with foreign institutional investors offloading shares worth Rs 1,832.46 crore on Monday, while domestic institutional investors offset the selling by pumping in Rs 2,446.33 crore, according to exchange data. Meanwhile, Brent crude prices edged lower by 0.51 per cent to USD 65.96 per barrel, offering additional comfort to markets.

The sharp surge extended the gains from the previous session, when the Sensex had risen 943.52 points to close at 81,666.46 and the Nifty had advanced 262.95 points to settle at 25,088.40, underscoring the renewed bullish momentum sweeping Indian equities.